New Zealand reverses foreign buyer ban to attract HNW wealth

New Zealand will allow golden visa holders to purchase a single high-value home, reversing part of the 2018 foreign buyer ban, with implementation scheduled from late 2025. This change widens the appeal of New Zealand as a lifestyle and investment hub and is set to boost demand for cross-border planning tied to property. Firms positioned with clear, compliant pre-departure property advisory and execution support stand to capture flows.

The government has created a narrow exemption that allows holders of New Zealand’s residence visa to buy or build one qualifying home worth NZ$5m ($2.9 million) or more. The move is designed to attract HNW capital while keeping most of the foreign buyer ban intact to balance growth objectives, helping revive New Zealand’s depressed property market while ensuring sufficient housing stock.

Go deeper with GlobalData

GlobalData HNW Expats Analytics 2025

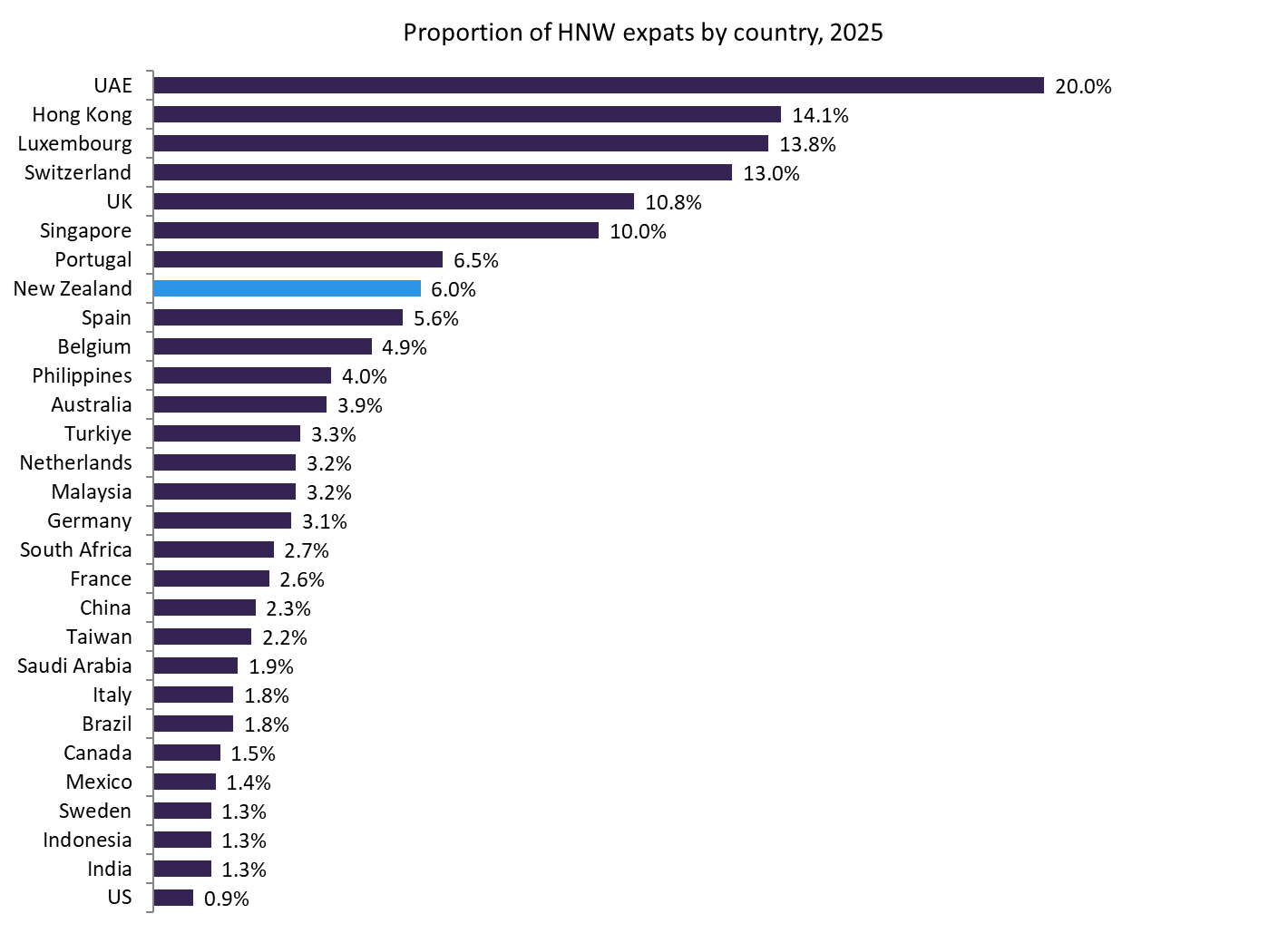

New Zealand is already a magnet for affluent families. GlobalData’s HNW Expats Analytics 2025 found that 6% of the local HNW population are expats versus 3.1% globally. Adding property as an incentive increases the country’s pull; prime residential real estate is perceived as a stable, safe store of value alongside broader investment commitments. Globally, more than a fifth of HNW offshore wealth is allocated to real estate according to GlobalData’s HNW Offshore Preferences Analytics 2025. Advisory demand is also evident: Globally, 76.6% of private wealth managers report “very strong” or “quite strong” HNW demand for overseas property advice.

However, momentum is unlikely to be driven by visa guidance alone. HNW investors increasingly expect an integrated proposition—with immigration advice paired with property sourcing, ownership structuring, tax and reporting, as well as ongoing management of the asset. Firms that deliver the full proposition—not just investor visa guidance—are best positioned to convert interest in New Zealand into durable relationships and multi-asset mandates.

Heike van den Hoevel is Principal Analyst, Wealth Management, GlobalData

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataContent Original Link:

" target="_blank">