MABUX showed a moderate upward trend

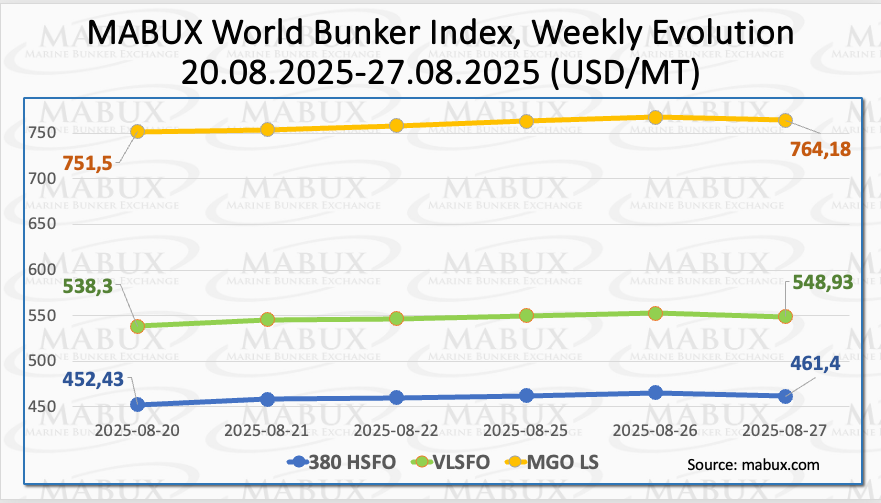

At the close of the 35th week, the global bunker indices MABUX showed a moderate upward trend. The 380 HSFO index rose by US$ 8.97, to US$ 461.40/MT, surpassing the US$ 460 mark. The VLSFO index gained US$ 10.63, nearing the US$ 550 threshold.

Meanwhile, the MGO index advanced by US$ 12.68, climbing US$ 764.18/MT, crossing the US$ 760 level. At the time of reporting, the global bunker market displayed no pronounced dynamics.

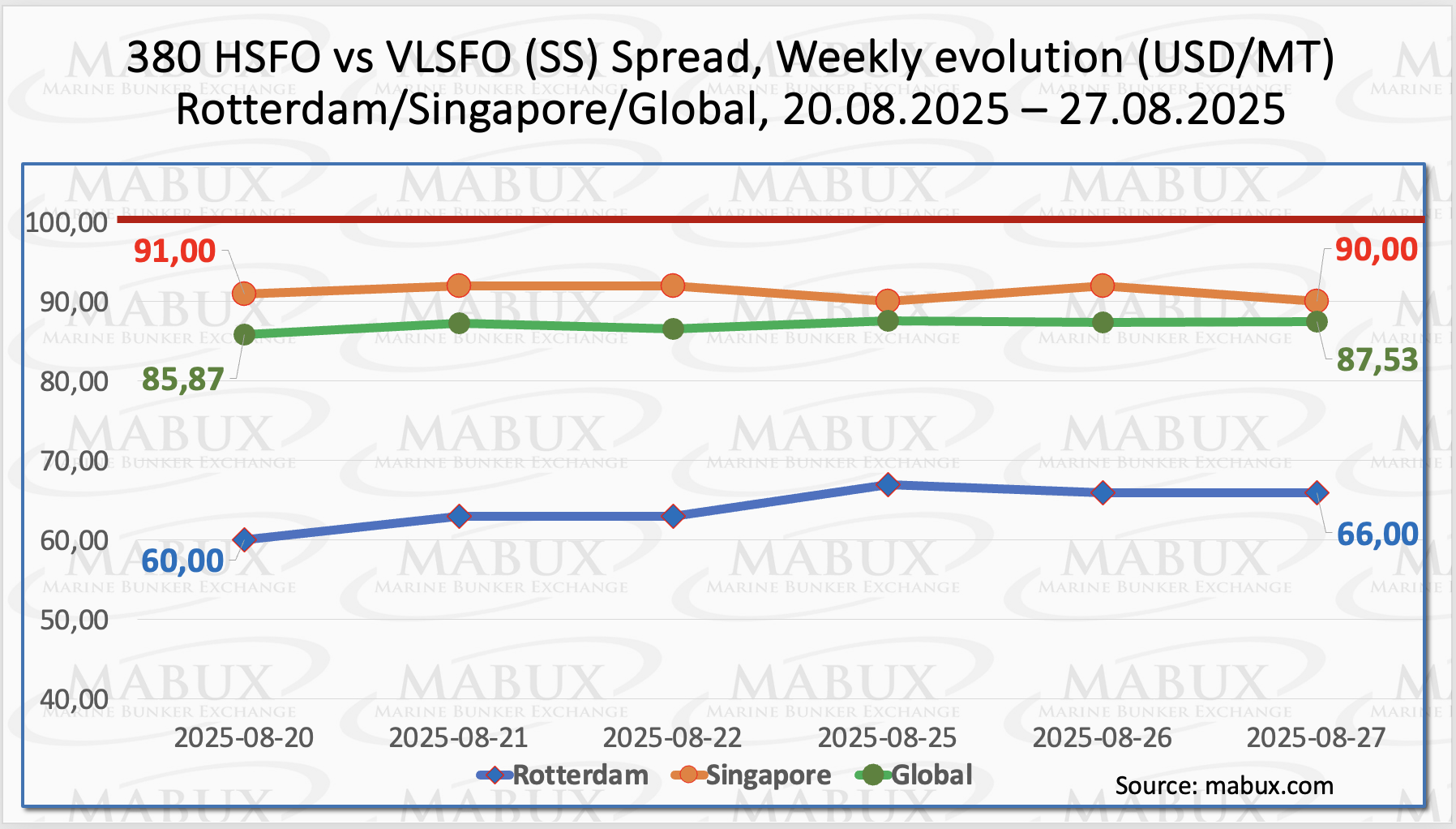

The MABUX Global Scrubber Spread (SS)—the price difference between 380 HSFO and VLSFO—rose by US$ 1.66, US$ 87.53, remaining steadily below the psychological threshold of $100.00 (SS Breakeven). The weekly average of the index likewise added US$ 1.63.

In Rotterdam, the SS Spread climbed by US$ 6.00, reaching $66.00. The port’s weekly average also strengthened by US$ 7.17. By contrast, in Singapore the 380 HSFO/VLSFO differential slipped by US$ 1.00, US$ 90.00, while the weekly average in the port still showed a modest increase of US$ 0.84.

At present, SS Spread values have stabilized at their current levels. We expect this trend to persist into next week. With the indices holding below the US$ 100.00 threshold, conventional VLSFO continues to demonstrate higher profitability compared with the HSFO + Scrubber option.

The International Energy Agency recently reported that it expected demand for natural gas to continue growing—and specifically demand for liquefied natural gas. The report sees global demand growth picking up again in 2026 and accelerating to around 2% as a considerable increase in LNG supply eases market fundamentals and fosters stronger demand growth in Asia. In 2026, LNG supply is set to rise by 7%, or 40 bcm – its largest increase since 2019 – as new projects come online in the United States, Canada and Qatar.

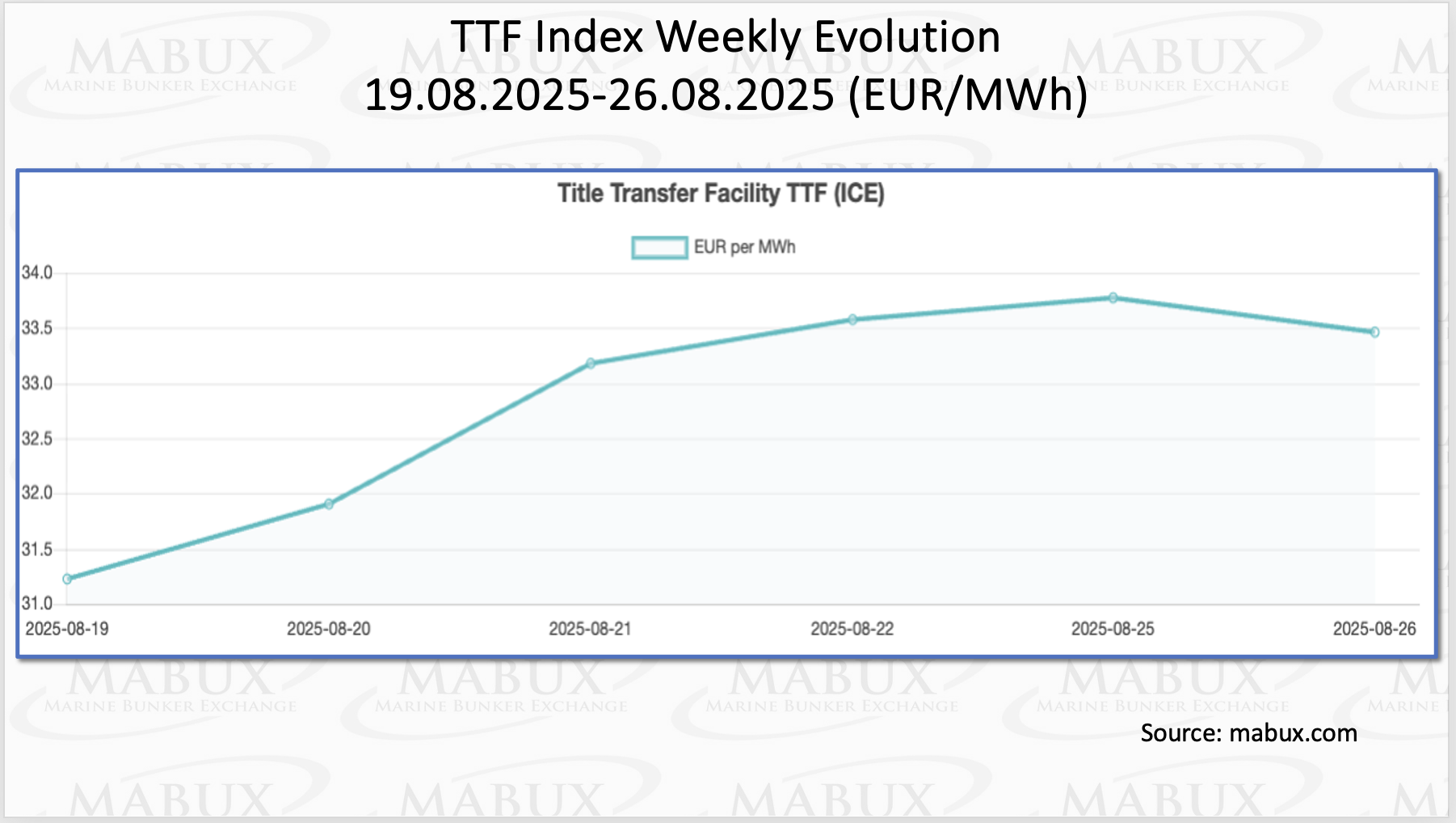

As of 26 August, European regional gas storage facilities were 76.24% full, reflecting a 2.03% increase from the previous week. Current occupancy stands 4.91% higher than at the beginning of the year (71.33%), with the pace of injections showing a moderate rise. By the close of the 35th week, the European TTF gas benchmark advanced by 2.413 EUR/MWh, reaching 33.460 EUR/MWh compared with 31.227 EUR/MWh a week earlier.

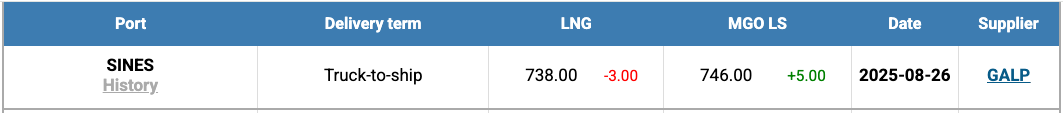

The price of LNG as a bunker fuel at the port of Sines (Portugal) rose by US$ 14.00 over the week, reaching 755 US$/MT. Meanwhile, the price gap between LNG and conventional fuel remained in favor of conventional fuel but narrowed significantly, dropping to US$ 9. On the same day, MGO LS was quoted at 746 US$/MT in Sines.

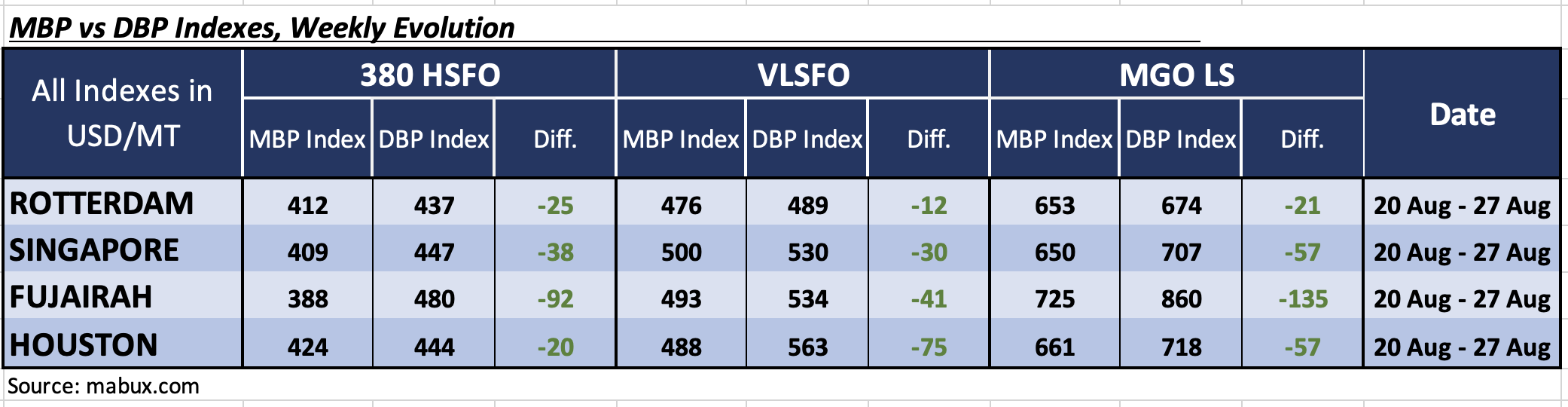

At the close of the 35th week, the MABUX Market Differential Index (MDI)—the ratio of market bunker prices (MBP) to the digital benchmark MABUX (DBP)—continued to indicate underpricing across all fuel types in the world’s largest hubs: Rotterdam, Singapore, Fujairah, and Houston:

• 380 HSFO segment: Average weekly underpricing widened by 10 points in Rotterdam, 3 points in Singapore, and 2 points in Fujairah, but narrowed by 4 points in Houston. Notably, Fujairah’s MDI continued its movement toward the $100 threshold.

• VLSFO segment: Underpricing increased by 1 point in Rotterdam and 4 points in Singapore, while Fujairah and Houston saw declines of 2 and 3 points respectively.

• MGO LS segment: MDI values climbed by 20 points in Rotterdam, 11 points in Singapore, 14 points in Fujairah, and 5 points in Houston. Fujairah’s MDI remained firmly above US$ 100.00.

“Overall, the structure of over- and undervaluation across ports showed no significant shifts during the week, with the undervaluation trend persisting across all fuel segments. No major changes in MDI dynamics are expected in the coming week,” said Sergey Ivanov, Director, MABUX.

“We expect the global bunker market to maintain its potential for moderate growth in the coming week,” commented Iavanov

The post MABUX showed a moderate upward trend appeared first on Container News.

Content Original Link:

" target="_blank">