The offshore rig market recovery appears to have taken a pause, with demand tapering off and marketed utilization hitting the lowest levels recorded since recovery began in 2021. A variety of factors

The offshore rig market recovery appears to have taken a pause, with demand tapering off and marketed utilization hitting the lowest levels recorded since recovery began in 2021. A variety of factors have contributed to this – including Saudi Aramco’s suspension of over 30 jackup contracts by up to one year, the entry of newbuild rigs into the market without work to go to, and the deferment of several long-term deepwater drilling and plug and abandonment projects.

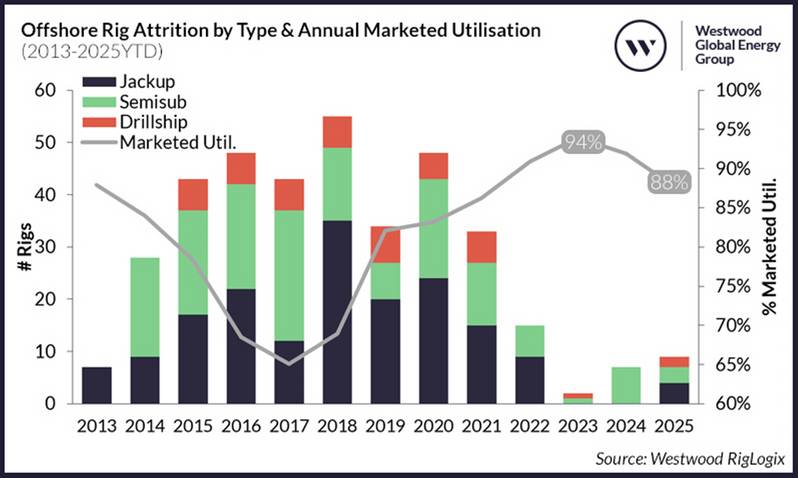

The unexpected combination of a dip in firm demand (currently 18% lower versus March 2024) and an increase in supply (7% higher than March 2021), has seen marketed utilisation fall to 88% as of March 2025 – representing a 6% drop in less than two years.

We’re only three months into 2025 and attrition this year is the highest it’s been since 2022. Additionally, with Westwood predicting utilisation of the combined jackup, semisub and drillship segments to fall further this year to around 85% – it seems likely that more rigs could permanently be removed from the active drilling fleet as the year progresses.

Content Original Link:

" target="_blank">