Maritime insurance forms the backbone

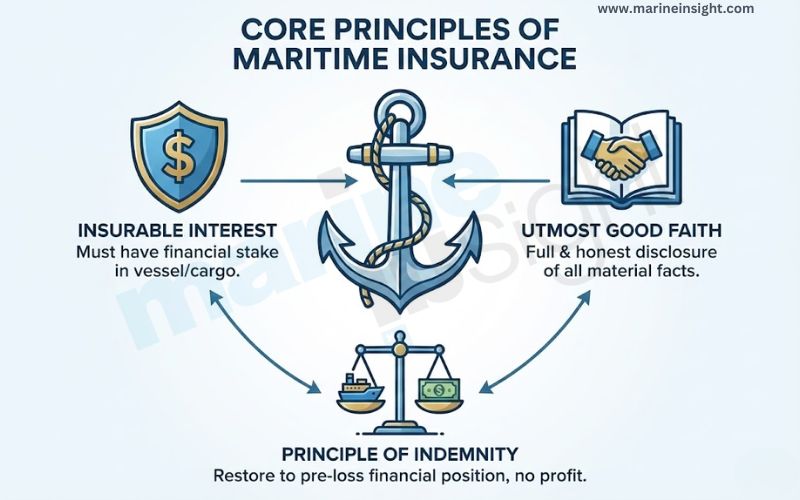

Maritime insurance forms the backbone of modern shipping by converting unpredictable sea risks into manageable commercial exposure. While policies may differ in scope and wording, they are all built on a few fundamental legal and commercial concepts that determine how risks are assessed, premiums are calculated, and claims are settled. Understanding these concepts is essential for anyone dealing with shipping, trade, or maritime law, as they explain why marine insurance works the way it does and how liabilities are ultimately allocated.

Below are some of the key concepts that shape maritime insurance practice across jurisdictions.

1. Insurable Interest

At the heart of any maritime insurance policy lies the concept of insurable interest. Simply put, the insured must be able to suffer a real financial loss if the subject matter of the insurance is damaged or lost. In shipping, this interest may arise from ownership of the vessel, cargo, freight, or even contractual exposure. Without insurable interest, a marine insurance contract cannot be legally enforced, as insurance is meant to

Content Original Link:

" target="_blank">