Maritime insurance operates within a

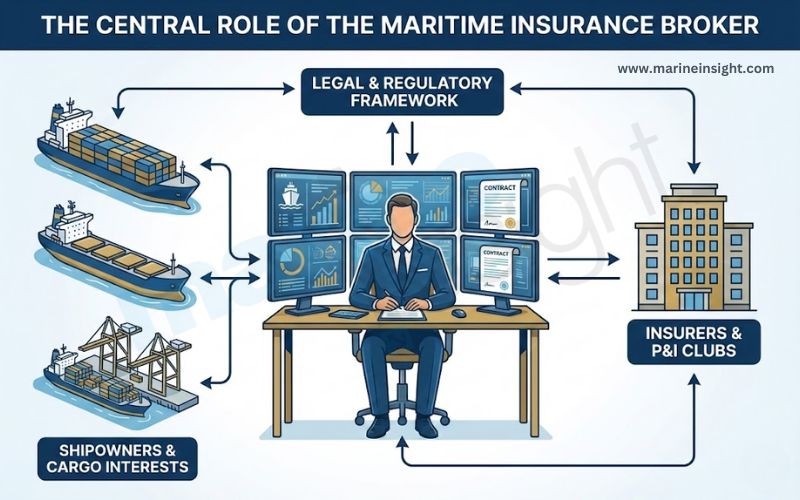

Maritime insurance operates within a complex legal and commercial framework, where even small gaps in coverage can expose shipowners, cargo interests, and charterers to significant financial risk. At the centre of this framework sits the maritime insurance broker—a professional whose role extends far beyond simply arranging policies. Brokers act as intermediaries, advisers, and problem-solvers throughout the life of an insurance contract.

Outlined below are the key duties of a maritime insurance broker, explained in a practical, industry-focused manner.

1. Assessing the client’s risk profile

One of the broker’s primary responsibilities is to understand the client’s operations in detail. This includes the type of vessel, trading routes, cargo carried, management standards, claims history, and regulatory exposure.

By analysing these factors, the broker identifies the specific risks faced by the assured. This risk assessment forms the foundation for selecting appropriate insurance cover and avoiding both underinsurance and unnecessary premium costs.

2. Advising on suitable insurance cover

Maritime insurance is not a single product but a combination of specialised covers, such as

Content Original Link:

" target="_blank">